"The current fight over how we should pay for affordable housing, and who will fund it, is beating on the wrong drum."

Social and environmental impact investing and businesses continue to capture the interest and imagination of the Pacific Northwest, part of a broader global trend. Local early adopters affiliated with Element 8, Impact HUB Seattle, Seattle Impact, Mission Investors Exchange and other institutions and individuals have forged impact investment paths that many others now find themselves traveling. It’s exciting to see the local impact investing ecosystem and communities flourish. However, a market imbalance persists with more impact investor dollars available than the limited number of qualified investment opportunities can absorb. Fortunately we’re seeing signs that the supply of impact investment opportunities is starting to catch up with demand from impact investors.

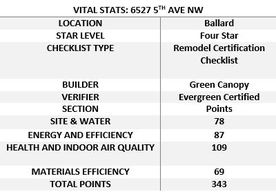

Green Canopy is an example of an impact-investor funded company that has been fueled by local early adopters. The company operates in a commodity industry: designing and building single family homes. However, we have been fortunate to attract thoughtful, impact-motivated equity and debt investors, due in large part to our mission, vision and values focused on achieving long term positive environmental and social change while simultaneously pursuing solid financial results.

Since 2011 Green Canopy has acquired nearly 90 projects; steadily building a community of homeowners, real estate agents, employees, shareholders and fund members that share our passion to inspire resource efficiency in residential markets. Importantly, we pursue our mission while being uncompromising in achieving key sustainability metrics, paying our employees a fair wage, selling our homes at fair market prices and generating long term shareholder value. Green Canopy has an opportunity to demonstrate it is not only possible, but highly rewarding for all involved to create and operate under a business model predicated on shared, blended value creation.

Similar opportunities are emerging across a wide spectrum of investment strategies that seek to satisfy growing consumer and investment demand for highly impactful market-driven solutions. As Seattle continues to attract tens of thousands of employees each year to fill quality jobs at companies like Amazon, Nordstom and Microsoft, our entire region feels the benefits. And yet, we are all faced with the unintended consequences of the additional infrastructure needed to support increased demand for critical services, including affordable workforce housing. The current fight between the City and the Coalition for Sustainable Jobs and Housing over how we should pay for affordable housing, and who will fund it, is beating on the wrong drum. Neither side seems to be asking the right questions or putting forth a broadly acceptable or effective solution for quickly increasing the supply of affordable workforce housing.

One example of an alternative solution is Bellwether Housing’s recently launched Seattle Futures Fund. Bellwether has successfully developed and managed affordable workforce housing in Central Seattle for 35 years. However, as affordable housing has become an increasingly rare commodity in the communities Bellwether serves, the organization has had to innovate how its projects are financed; necessity = the mother of innovation. Through the Seattle Futures Fund, Bellwether believes it will more rapidly scale the number of units available to house social workers, teachers, baristas, police officers, firefighters, government workers, data center workers and others that serve our communities. A potentially wonderful, local example that attracts private capital as part of the solution to develop housing that is affordable and accessible to our urban working families.

As a community, we must collaboratively develop innovative, smart, market-driven solutions to problems that impact a wide range of constituents. Hopefully, a greater supply of viable impact investment opportunities for investors to assess, like Bellwether’s Seattle Futures Fund, will be forthcoming in the near-term. In the meantime, we would encourage investors and entrepreneurs alike to continue viewing our social and environmental problems through the lens of impact opportunity.

Contributed by Kyle Mylius, Board of Directors for Green Canopy, Inc. & Aaron Fairchild, CEO of Green Canopy, Inc.